As government-backed mortgage programs, FHA and VA loans are some of the most affordable options for home loans. Now, thanks to a couple of changes, they are helping homebuyers to keep even more money in their pockets. For FHA loans, MIP is decreasing, and for some VA loans, funding fees are decreasing.

New Lower FHA MIP

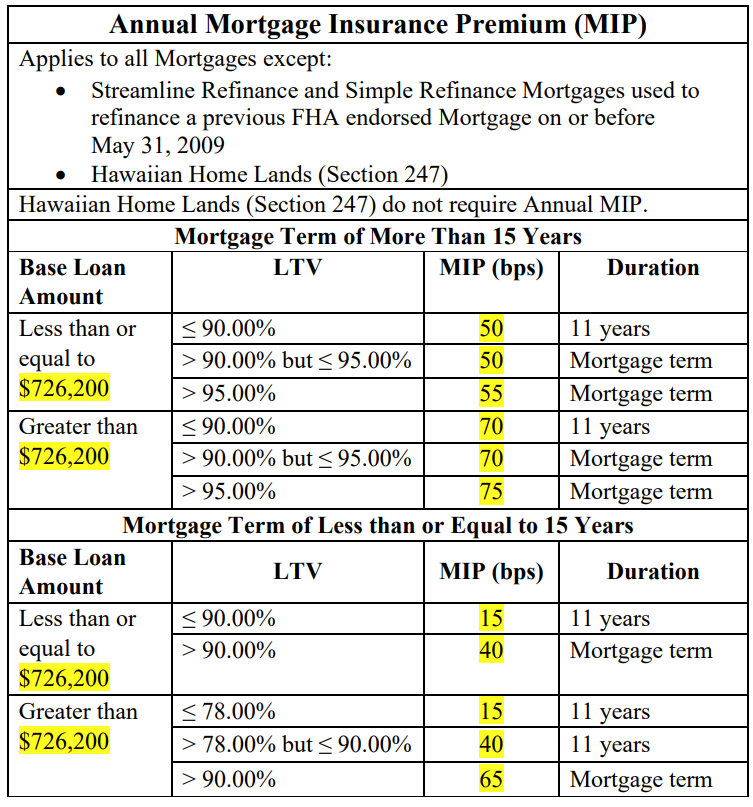

If you take out an FHA mortgage backed by the Federal Housing Administration, you need to pay monthly mortgage insurance premiums (MIP). As of March 20th, 2023, these premiums are dropping by 30 bps.

This reduction will impact an estimated 850,000 borrowers. Their savings added together should amount to an estimated $678 million.

HUD states, “For the same borrower with a mortgage of $467,700 – the national median home price as of December 2022 – FHA’s annual MIP reduction will save them more than $1,400 in the first year of their mortgage. In addition to providing overall savings to borrowers, a lower annual MIP can also help more people qualify for a mortgage.”

Reduced VA Funding Fees for Some Mortgages

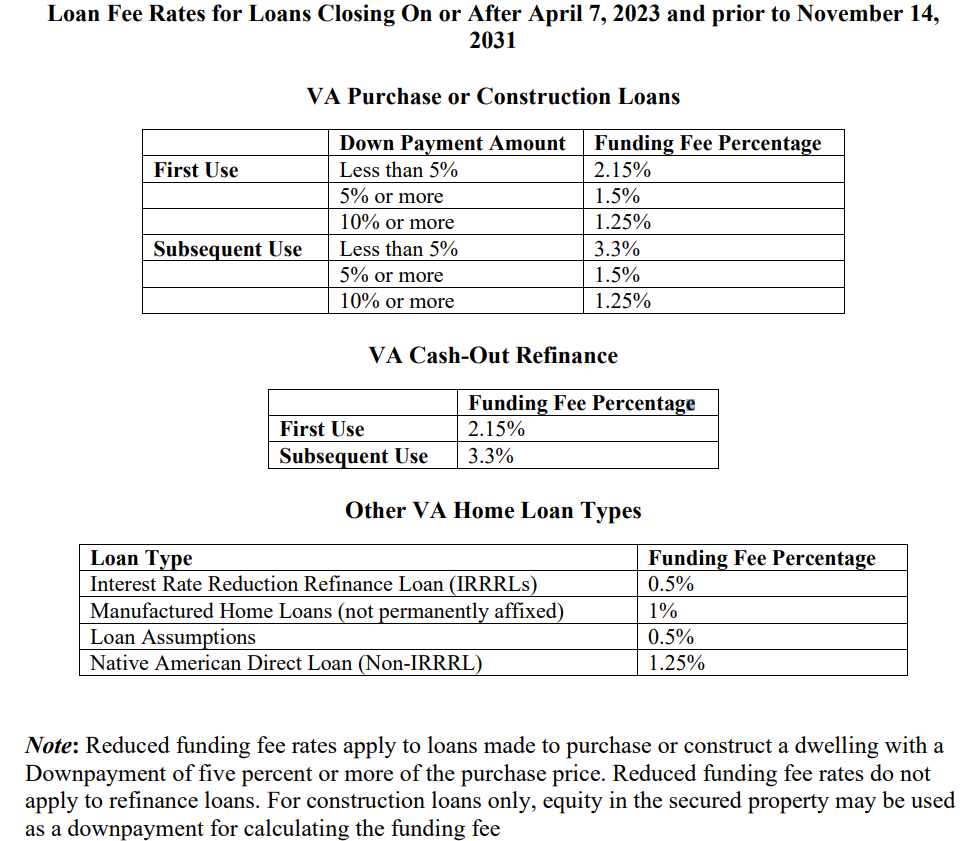

When applying for a mortgage that will close on or after April 7th, 2023 and before November 14th, 2031, you may have the chance to qualify for reduced funding fees for your VA loan.

A 5% or more down payment is a requirement for the lower funding fees, as is using the mortgage for construction or purchase of a home. Funding fees are not being lowered for refinances.

Apply for an FHA or VA Mortgage

Now that you may qualify for reduced VA mortgage funding fees or FHA MIP, you can save on the costs to purchase a home. If you are ready to apply, please call (816) 631-9687. We can help you buy a home in Missouri and 30 different states.

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Today's Mortgage Rates