TL;DR Understanding how do HELOCs work is essential for homeowners looking to tap into their property’s value without a fixed lump sum. A home equity line of credit (HELOC) functions as a revolving credit line where you borrow against your equity as needed.

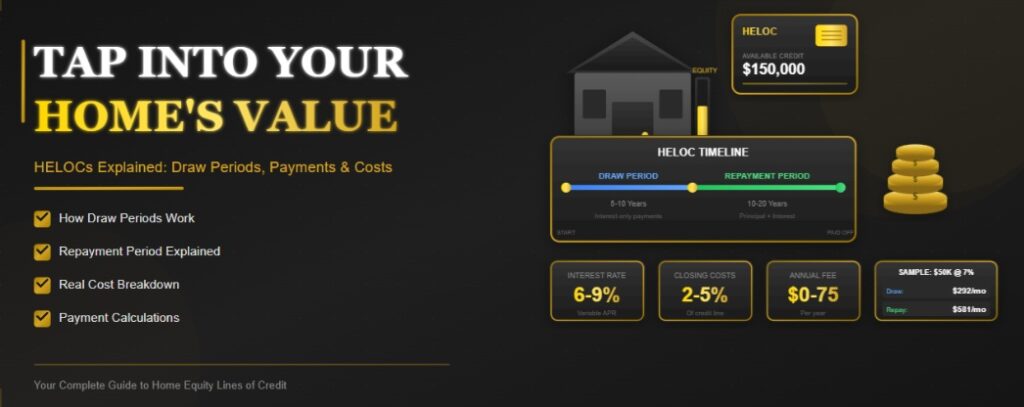

Most agreements consist of a 5–10 year HELOC draw period—often requiring interest-only payments—followed by a 10–20 year HELOC repayment period. Because HELOC interest rates are typically structured as a variable-rate HELOC, monthly costs can fluctuate based on market conditions.

When comparing a home equity loan vs HELOC, the primary difference lies in this flexibility: you only pay for what you use, though total costs can rise significantly if interest rates climb or balances aren’t managed carefully.A Home Equity Line of Credit (HELOC) provides homeowners with a flexible way to access their property’s value. Unlike a lump-sum home equity loan, a HELOC operates as a revolving line of credit, allowing you to borrow against your home equity only as needed.

Key features of a HELOC include:

- Structure: Most HELOCs have two phases: a draw period (typically 5–10 years) where funds are accessed, often requiring only interest payments, and a repayment period (usually 10–20 years).

- Interest Rates: HELOC rates are generally variable. This means monthly costs can change based on current market conditions.

- Flexibility vs. Risk: The primary advantage over a traditional home equity loan is the flexibility—you only incur costs on the amount you draw. However, this variable-rate structure means total costs can increase significantly if interest rates rise or the balance is not managed prudently.

Understanding this structure is crucial for homeowners considering using a HELOC.

What Is a HELOC and How Does It Work?

A home equity line of credit (HELOC) functions as a revolving credit line secured by your home. It works similarly to a credit card but uses your property as collateral. To understand how do HELOCs work compared to traditional loans, the key difference is access to funds. Instead of a single lump sum, you receive a predetermined credit limit that you can borrow from, repay, and borrow from again during the draw period.

This revolving structure offers several unique benefits:

- Interest Savings: You only pay interest on the actual amount you borrow, not the entire credit limit.

- Flexible Borrowing: If you are approved for $75,000 but only draw $30,000, your payments are based only on that $30,000 balance.

- Reusable Funds: You can repay a balance and borrow it again without reapplying, provided you are within your draw period.

How do HELOCs work over the long term? They operate in two distinct phases:

- The Draw Period: Typically lasting 5–10 years, this is the initial phase where you access funds as needed and usually make interest-only payments.

- The Repayment Period: Once the draw period ends, the credit line closes. You can no longer borrow money and must begin paying back both principal and interest on the remaining balance, usually over 10–20 years.

This two-phase structure is what makes HELOCs fundamentally different from other loan options, offering flexibility initially but requiring careful planning for the transition ahead.

HELOC at a Glance

| Feature | HELOC |

| Loan Type | Revolving line of credit |

| Collateral | Your home |

| Interest Rate | Variable (usually) |

| Draw Period | 5–10 years |

| Repayment Period | 10–20 years |

| Payments During Draw | Interest-only (common) |

How Is a HELOC Approved and How Is the Credit Limit Set?

Lenders evaluate HELOC applications using three primary factors: your creditworthiness, available equity, and ability to repay. The application process resembles applying for a mortgage, requiring documentation of income, employment, debts, and assets.

Your lender will order an appraisal to determine your home’s current value, which directly impacts how much you can borrow.

The credit limit calculation centers on combined loan-to-value ratio (CLTV), which measures your total mortgage debt against your home’s appraised value. Most lenders cap CLTV at 80–85%, meaning they’ll let you borrow up to that percentage of your home’s value minus what you still owe on your existing mortgage.

If your home appraises for $400,000 and you owe $250,000 on your first mortgage, an 80% CLTV allows total debt of $320,000, giving you access to a $70,000 HELOC.

Credit score requirements vary by lender but typically fall between 680 and 720 for approval. Your debt-to-income ratio matters too—most lenders want to see total monthly debt payments (including the projected HELOC payment) staying below 43% of your gross monthly income.

Understanding the mortgage process can help you prepare the necessary documentation and strengthen your application before applying.

Typical HELOC Approval Requirements

| Factor | Typical Requirement |

| Credit Score | 680–720+ |

| Max CLTV | 80%–85% |

| Income | Verifiable & stable |

| Debt-to-Income | ≤ 43% |

| Home Equity | 15%–20% minimum |

What Is the Draw Period on a HELOC?

The draw period represents the initial phase of your HELOC when you can access your credit line and make withdrawals as needed. This period typically lasts between 5 and 10 years, though the exact duration depends on your lender and the specific terms of your agreement. During this time, you function as an active borrower with ongoing access to funds up to your credit limit.

Withdrawals work through various methods depending on your lender’s offerings. Many provide checks, debit cards linked to your HELOC account, or online transfer capabilities. You can draw the full amount immediately, take partial draws over time, or keep the line untouched as an emergency reserve. The revolving nature means paid-down balances become available to borrow again without additional approval.

When considering how do HELOCs work in your day-to-day budget, it is important to note that minimum payment calculations during the draw period focus primarily on interest charges. Most lenders require you to pay at least the monthly interest accrued on your outstanding balance, though you are always free to pay more toward the principal if you choose.

These interest-only payments keep monthly obligations low initially but do not reduce what you owe—your balance only decreases when you make payments exceeding the interest charge.

HELOC Draw Period Explained

| Item | Details |

| Length | 5–10 years |

| Payments | Interest-only (most cases) |

| Can Borrow Again? | ✅ Yes |

| Balance Changes | Flexible |

How Are HELOC Monthly Payments Calculated During the Draw Period?

Interest-only payment calculations follow straightforward math. Take your current balance, multiply it by your annual interest rate, then divide by 12 to get your monthly payment.

If you’ve borrowed $40,000 at an 8.5% rate, the calculation looks like this: $40,000 × 0.085 = $3,400 annual interest ÷ 12 months = $283 monthly payment.

These payments feel manageable because you’re only covering the interest charge without touching the principal balance. A $50,000 balance at 8.5% requires roughly $354 per month during the draw period, compared to potentially $700+ per month if you were paying both principal and interest from day one.

This payment structure makes HELOCs attractive for borrowers who need immediate access to funds without immediately high monthly obligations.

The danger lies in mistaking low payments for low cost. While your monthly bills stay small, your actual debt isn’t shrinking unless you voluntarily pay extra toward principal. You’re essentially renting your own money each month, and that $50,000 balance will remain $50,000 until you actively work to pay it down or the repayment period forces you to do so.

Using a mortgage calculator can help you model different payment scenarios and understand the long-term costs.

Payment Example: $50,000 HELOC at 8.5%

| Balance | Monthly Payment (Interest-Only) |

| $25,000 | ~$177 |

| $50,000 | ~$354 |

How Do Monthly Payments Change When a HELOC Enters Repayment?

The transition from the draw period to the repayment period marks the most significant change in HELOC management. When your draw period ends, your credit line closes immediately—you can no longer access funds or borrow additional money. The balance you carry at that moment becomes a term loan that you must fully repay over the remaining period, typically 10 to 20 years.

“Payment shock” describes what happens when your comfortable interest-only payments suddenly transform into fully amortizing payments covering both principal and interest. Part of understanding how do HELOCs work is recognizing this shift: that same $50,000 balance that cost you $354 monthly during the draw period might jump to $650 or more per month during repayment, depending on your interest rate and the length of your term.

The payment increase isn’t due to penalty fees or rate hikes—it simply reflects the mathematical reality of paying off debt rather than merely maintaining it.

Smart HELOC users plan for this transition years in advance. Common strategies include:

- Aggressive Principal Payments: Paying down the balance during the draw period to reduce the final repayment burden.

- Refinancing: Moving the balance into a traditional home equity loan with fixed monthly payments.

- Loan Modification: Working with a lender to extend or modify the terms before the draw period expires.

If you’re considering a HELOC, factor the repayment phase into your budget from day one—not just the artificially low draw-period payments. For borrowers exploring alternatives, understanding different mortgage refinance options can provide valuable context for long-term financial planning.

Draw Period vs Repayment Period

| Feature | Draw Period | Repayment Period |

| Payments | Interest-only | Principal + interest |

| Flexibility | High | None |

| Payment Amount | Lower | Higher |

| Borrowing Allowed | Yes | No |

How Are HELOC Interest Rates Structured?

Variable-rate HELOCs tie your interest rate to a benchmark index, most commonly the prime rate set by major banks based on Federal Reserve policy. Your actual rate equals the prime rate plus a margin determined by your lender based on your credit profile, home equity, and other risk factors.

If prime stands at 8.5% and your lender adds a 1.0% margin, your HELOC rate is 9.5%.

Rate adjustments happen periodically—monthly, quarterly, or annually depending on your agreement. When the Federal Reserve raises or lowers rates, prime rate typically moves in tandem, and your HELOC rate adjusts accordingly.

This creates payment uncertainty since your monthly interest charge fluctuates with market conditions. A rate that starts at 7% might climb to 10% or higher during periods of monetary tightening.

Most HELOCs include rate caps limiting how much your interest rate can increase. A periodic cap might restrict rate changes to 2% per adjustment period, while a lifetime cap might prevent your rate from exceeding 18% regardless of market conditions.

Rate floors also exist, ensuring lenders maintain a minimum return even if benchmark rates drop significantly. Before signing, confirm your HELOC includes both periodic and lifetime caps to protect against extreme rate volatility.

Staying informed about mortgage rates and housing trends can help you time your HELOC application strategically.

Variable-Rate HELOC Example

| Component | Example |

| Prime Rate | 8.5% |

| Lender Margin | +1.0% |

| HELOC Rate | 9.5% |

What Fees and Closing Costs Come With a HELOC?

HELOC fees vary significantly across lenders, with some offering “no closing cost” products that eliminate upfront charges while others structure fees similar to a traditional mortgage. Common upfront costs include appraisal fees ranging from $0 to $500, origination or application fees potentially reaching 1% of your credit limit, title search and recording fees, and credit report charges.

Ongoing costs appear after closing and throughout your HELOC’s life. Annual maintenance fees typically run $50 to $100 per year, charged simply for keeping your credit line open even if you never draw from it.

Transaction fees might apply when you access funds, and inactivity fees could hit if you don’t use your line within a certain timeframe. Some lenders charge for paper statements or check orders.

Early closure penalties protect lenders from losing money on borrowers who close their HELOC shortly after opening it. If you pay off and close your HELOC within the first two or three years, expect fees ranging from $300 to $500 or more.

These penalties reimburse lenders for their origination costs, which they typically recoup through interest over time. Read your HELOC agreement carefully before signing to understand exactly what you’ll pay upfront, annually, and potentially at closure.

Typical HELOC Fees

| Fee Type | Typical Cost |

| Appraisal | $0–$500 |

| Origination | $0–1% |

| Annual Fee | $50–$100 |

| Early Closure Fee | $300–$500 |

Is a HELOC Better Than a Home Equity Loan?

Home equity loans and HELOCs both tap into your home’s equity but work fundamentally differently. A home equity loan delivers a lump sum at closing with a fixed interest rate and predictable monthly payments, operating exactly like a second mortgage. In contrast, a HELOC provides revolving access to funds with a variable rate and flexible borrowing throughout the draw period.

Because of these differences, understanding how do HELOCs work is essential before choosing one over a traditional loan. The flexibility of a line of credit is powerful, but it requires more active management than a fixed-rate loan.

Choose a home equity loan when:

- You need a specific amount for a one-time expense.

- You want payment certainty and long-term budgeting stability.

- You are tackling major projects like complete home renovations or large debt consolidation.

Choose a HELOC when:

- You face ongoing expenses with an uncertain total cost (like phased home improvements).

- You want an emergency backup fund or a safety net for unexpected costs.

- You prefer to borrow only what you actually use, paying interest only on the active balance.

Just remember that variable rates and the potential for payment shock during the repayment phase make HELOCs riskier for borrowers who prefer stable, unchanging monthly obligations. Choosing the right tool depends entirely on whether you value the predictability of a loan or the flexibility of a revolving line.

HELOC vs Home Equity Loan

| Feature | HELOC | Home Equity Loan |

| Funds | As needed | Lump sum |

| Rate | Variable | Fixed |

| Payments | Flexible early | Fixed |

| Best For | Ongoing expenses | One-time costs |

What Is the Best Way to Use a HELOC?

Home improvements represent one of the strongest HELOC use cases, especially when you’re uncertain about total project costs or completing work in phases. Renovations that add value to your property—kitchen remodels, bathroom upgrades, additions—justify borrowing against your home since they directly enhance the collateral securing the loan.

The revolving structure lets you draw funds as contractors bill you rather than taking a lump sum upfront.

Debt consolidation through a HELOC makes mathematical sense when you’re replacing high-interest credit card debt with lower-interest secured borrowing. Moving $30,000 from credit cards charging 22% APR to a HELOC at 9% substantially reduces interest costs.

However, this strategy only works if you address the spending habits that created credit card debt initially. Trading unsecured debt for secured debt means you’ve put your home at risk—if you can’t repay a credit card, they damage your credit, but if you can’t repay a HELOC, you lose your house.

Emergency reserves work well with HELOCs since you pay nothing if you never draw funds (besides potential annual fees). Maintaining access to $50,000 for unexpected medical bills, urgent home repairs, or income loss provides financial security without the cost of carrying a loan balance.

Some borrowers maintain HELOCs specifically for this purpose, never intending to use them unless absolutely necessary. Avoid using HELOCs for discretionary spending, vacations, vehicles, or any expense that doesn’t justify secured borrowing against your home.

For guidance on managing your overall financial strategy, consider exploring resources available through McGowan Mortgages’ educational content.

What Are the Risks of a HELOC?

HELOC Risks to Understand:

- Variable rates can lead to rising payments

- Payment shock after draw period ends

- Your home serves as collateral

- Temptation to overspend

Variable interest rates create the most immediate risk for HELOC borrowers. When rates rise, your monthly payment increases even if your balance stays constant. A 2% rate increase on a $50,000 balance adds roughly $83 to your monthly payment—manageable for some but potentially budget-breaking for others.

During periods of aggressive rate hikes, like 2022-2023 when the Federal Reserve raised rates multiple times, HELOC payments can balloon significantly.

The two-phase payment structure poses a subtler but potentially more dangerous risk. Borrowers who focus only on affordable draw-period payments often fail to prepare for the transition to repayment. When that $400 monthly payment suddenly becomes $750, some households simply can’t absorb the difference.

The temptation to treat a HELOC like “free money” during the draw period leads to overspending, with borrowers maximizing their credit lines without considering long-term repayment obligations. Your home secures every dollar you borrow—foreclosure becomes a real possibility if life circumstances change and you can’t meet your obligations.

What Happens If Home Values Fall or I Can’t Repay?

Declining home values affect your HELOC in two critical ways. First, you might find yourself owing more than your home is worth if you have borrowed heavily and property values drop significantly. Second, lenders monitor loan-to-value (LTV) ratios on existing accounts and can freeze or reduce your credit line if your home’s value falls below certain thresholds.

A central part of how do HELOCs work that many borrowers overlook is the lender’s right to protect their collateral. During the 2008-2009 financial crisis, millions of homeowners had their HELOC credit lines frozen or reduced as property values plummeted.

A frozen credit line means you can no longer draw additional funds even though you are technically still in your draw period. You must continue making payments on any outstanding balance, but the lender has closed access to prevent you from borrowing into a negative equity position. This creates significant problems for borrowers who were counting on HELOC access for ongoing expenses or emergencies.

Inability to repay your HELOC leads to foreclosure just as failure to pay your primary mortgage does. Because your home is the collateral, the consequences of default are severe. If you find yourself struggling, contact your lender immediately to discuss options:

- Forbearance Programs: Temporary pauses or reductions in payments during financial hardship.

- Loan Modifications: Changing the terms of the HELOC to make payments more manageable.

- Refinancing: Moving the debt into a different loan structure, though this requires sufficient equity.

- Selling the Home: Exploring a sale to pay off all mortgages before foreclosure proceedings begin.

Understanding the risks is just as important as knowing the benefits. When you grasp how do HELOCs work during a market downturn, you can borrow more conservatively to protect your home.

If you’re facing financial difficulties, seeking guidance through professional mortgage consultation can help you understand your options before the situation becomes critical.

Frequently Asked Questions

How long is the draw period on a HELOC?

The draw period typically lasts 5 to 10 years, during which you can access funds and usually make interest-only payments. Once this period ends, you enter the repayment phase where you can no longer borrow and must pay back both principal and interest.

How is interest calculated on a HELOC?

Interest is calculated daily on your outstanding balance using your variable rate. Your monthly payment equals your balance multiplied by your annual rate, divided by 12. If rates or your balance changes, your payment adjusts accordingly.

Is a HELOC a good idea?

A HELOC works well for borrowers with steady income, strong financial discipline, and specific needs for flexible access to funds. It’s less suitable if you prefer predictable payments, struggle with debt management, or don’t understand the risks of variable rates and payment shock. Learn more about different loan options to determine what fits your situation.

Can I use a HELOC for debt consolidation?

Yes, many borrowers use HELOCs to consolidate high-interest debt like credit cards. While this can save significant interest, it converts unsecured debt into secured debt backed by your home. Make sure you address underlying spending habits before risking your house to pay off credit cards.

What happens if I can’t repay my HELOC?

Failure to repay can lead to foreclosure since your home secures the debt. Contact your lender immediately if you’re struggling—many offer forbearance, modification programs, or payment plans. You might also consider refinancing options or selling the property before foreclosure proceedings begin.

Is a HELOC better than refinancing?

It depends on your goals. A cash-out refinance replaces your existing mortgage with a larger one, providing a lump sum at a fixed rate. A HELOC adds a second lien with flexible access and variable rates. Refinancing makes sense for large one-time needs and when you want to lock in a low fixed rate, while HELOCs suit ongoing or uncertain expenses.

Can HELOC payments go up?

Yes, HELOC payments can increase in two ways: when variable interest rates rise, your payment goes up even with the same balance, and when you enter the repayment period, your payment structure shifts from interest-only to principal-plus-interest, often doubling or tripling your monthly obligation.

Conclusion

HELOCs provide flexible access to home equity, but their revolving structure, variable rates, and two-phase payment system make them more complex—and riskier—than traditional loans. Homeowners who understand how draw periods, interest-only payments, and repayment transitions work can use a HELOC strategically for home improvements, emergency reserves, or debt consolidation.

Those who ignore these mechanics may face significant payment shock and equity loss.

The key to successful HELOC management lies in treating it as a serious financial obligation rather than easy money. Calculate your true costs beyond the draw period, plan for variable rate increases, and maintain the discipline to pay down principal even when you’re not required to.

Your home secures every dollar you borrow—protecting that collateral means borrowing conservatively and repaying responsibly.

Before opening a HELOC, compare it against alternatives like home equity loans, cash-out refinancing, or personal loans to ensure you’re choosing the right tool for your specific needs. If you need guidance evaluating your options, contact McGowan Mortgages to discuss your situation with experienced professionals who can help you make an informed decision.

You can also schedule a consultation to explore whether a HELOC aligns with your long-term financial goals.

Ready to Explore Your Home Equity Options?

Whether you’re considering a HELOC or exploring other financing options, McGowan Mortgages can help you understand your choices and find the right solution for your financial situation.

Contact Us Today | Schedule a Consultation

Additional Resources

- Browse Our Complete Learning Center

- Home Buying Guides and Resources

- Subscribe to Our Newsletter for Market Updates

- Learn More About McGowan Mortgages

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Today's Mortgage Rates