⭐ Back-to-Back 2024 & 2025 🥇🥇

🏆Back-to-Back Winners!🏆We’re honored to share that McGowan Mortgages has officially been named Best Home Mortgage Company in Kansas City by the Kansas City Star for 2024 & 2025!

While we help clients from coast to coast, there’s nothing quite like being recognized in our hometown. This award means the world to us. To our amazing clients, thank you for your trust. To our team—you are the heart of it all. We take pride in showing up, doing the work, and making sure every client is taken care of like family. We’ve got even more exciting things in store, but today, we’re simply grateful. 💙 … and that’s not the only good news of the week!

📉 Mortgage Rates Just Hit Their Lowest Point of the Year

Yep — rates just dipped to their lowest levels in 2025 so far. That’s a big deal whether you’re:

🏡 Buying your first home

🔁 Thinking of refinancing

💵 Exploring a HELOC or cash-out

📈 Upgrading to your next dream property

Lower rates = more buying power and potentially lower monthly payments. Now is a smart time to run the numbers again.

See article below on WHY DID MORTGAGE RATES DROP – and WHAT’S NEXT?

🚫 Trigger Leads Are (Almost) Gone — Here’s Why That’s a Big Win for Everyone 🎉

If you’ve ever applied for a mortgage and then suddenly your phone blows up with calls, texts, and emails from other lenders you’ve never heard of… you’ve experienced what’s known as a “Trigger Lead.” 😠

The good news?

Congress just voted to ban them. ✅

The House of Representatives recently passed the bill, and the Senate passed it earlier this year. Now we’re simply waiting for it to be signed into law — and once that happens, this shady practice will finally be shut down.

So What Are Trigger Leads? 🤔

Let’s break it down:

You apply for a mortgage.

Your lender pulls your credit (this is totally normal).

The credit bureaus (like Experian, TransUnion, and Equifax) sell your information to other mortgage companies the moment that credit is pulled.

Those other lenders then bombard you with calls and emails — sometimes even pretending to be your original lender to trick you into switching. Not cool.

This tactic has caused:

😤 Confusion and stress for homebuyers

😡 Unwanted spam and misleading sales calls

😨 Some borrowers to accidentally switch lenders and derail their deals

We’ve seen firsthand how damaging it can be. It’s a desperate and deceptive practice — and it’s one we’ve worked hard to protect our clients from.

How We’ve Been Protecting You 🛡️

At our office, we’ve taken every step we can:

Every loan application we send includes an Opt-Out Prescreen link to help block trigger leads before they start.

Our team double-checks each client’s status and submits that opt-out request for you — even if you forget.

We often start with a soft credit check so you can explore options without triggering the madness.

But now, we’re thrilled to know this added layer of protection will soon be the law of the land. 👏

Why This Matters to Buyers and Realtors 🏡

Less confusion = smoother buying experience

No more surprise calls = fewer deals falling apart

Honest lenders (like us 😉) can keep doing great work without distractions

If you’re working with a lender, you should feel safe, informed, and respected — not hustled. This move from Congress is a major win for anyone who wants a cleaner, more ethical home loan experience.

🎙️ I Was Honored to Join the “Coaching with Chris” Podcast!

Recently, I had the privilege of being a guest on the Coaching with Chris podcast hosted by none other than Chris Vinson, the founder of Windsor Mortgage—and honestly, one of the most positive forces in our industry.

We talked about what it’s like building a mortgage business and a high-performing team in today’s wild market 🌀.

We dove into how we’re using top-tier technology and how crucial it is to surround yourself with the right people. It was one of those conversations that just flows—real, insightful, and energizing.

A few takeaways that really stuck with me:

💡 Chris embodies an abundance mindset. He’s always showing up, helping brokers, and genuinely rooting for the greater good in our industry.

😄 His energy is contagious. Whether at events or on a podcast, the guy shows up with a smile—and it spreads.

📚 He’s a student of the game. Even as the owner of a fast-growing company, he’s still taking notes, asking questions, and looking for ways to improve. That’s leadership.

I’m grateful for partners like Windsor Mortgage. They’ve helped many of our clients and continue to be a strong investor relationship for our team. And I’m thankful for people like Chris who are raising the bar in this business.

We’re just getting started—and I’m excited to keep growing, learning, and serving more families 🏡🙏

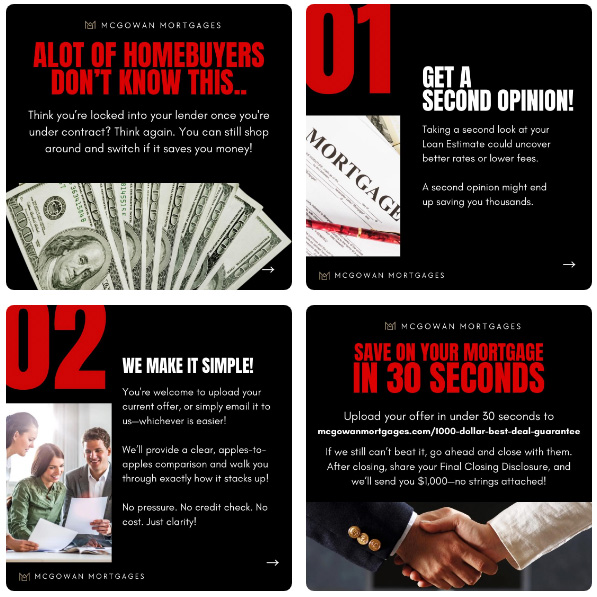

🏡 Thinking About Switching Lenders Mid-Process? You’re Not Alone.

We hear this a lot:

“I already started my mortgage with another lender… it feels too late to switch.”

Totally understandable! But here’s the truth 👉 it’s more common—and easier—than you might think.

Let’s break it down:

✅ Why People Hesitate:

They already started the process

Paperwork is submitted

Appraisal or title may be in motion

Fear of “starting over” or messing up the timeline

🔄 But Here’s What Most Don’t Realize:

You’re not starting over — we can use your existing appraisal, title, insurance, and documents

You’re not alone — we guide you every step of the way, and most transfers are seamless

You could save thousands — literally, studies show we save our clients over $10,000 on average just from better rates over the life of the loan

We shop hundreds of banks and lenders for every client. That’s our thing.

💰 And to prove it?

We offer a $1,000 Best Deal Guarantee —

If we can’t beat another lender’s deal on the same day, apples to apples, we’ll pay you $1,000 just for the shot.

⚡ Real Talk:

If the deal you have is already amazing, great! But if you haven’t compared yet, you could be missing out on serious savings… and we’d love the chance to help.

Even if you’re mid-process, or know someone who is, feel free to reach out.

We’re here to make switching easy if it makes sense—and worth it if we can save you money.

🎯 Three Reasons to Prep Early for Your Home Loan 🏡💡

1️⃣ Waiting to pay off debt?

It might not help like you think. Sometimes that wait can cost you more in the long run—home prices and interest rates move fast!

2️⃣ Trying to boost your credit score?

That’s great—but don’t wait months just for a small bump. 🕒 We’ve helped people improve their score in just a few days with smart, strategic steps that actually matter. Meanwhile, the market could shift by thousands of dollars.

3️⃣ Don’t get caught scrambling.

Too often, people hold off—then the perfect house pops up and they’re not ready. They miss it because they weren’t prepped. 😬

📑 Prepping early = less stress, more leverage, and better deals.

🙋♂️ We help you get your ducks in a row so you’re ready before it matters—and it could save you big.

Why did Mortgage Rates Drop? And What’s Next?

📉 Mortgage Rates Just Got a Boost—Here’s Why

Last week, we said “wait for the jobs report”—and it did not disappoint. While the rest of the week had plenty of market-moving news (Fed announcement, GDP numbers, inflation updates), nothing hits mortgage rates like the monthly jobs report. And this one brought some surprises that tipped the scales in our favor.

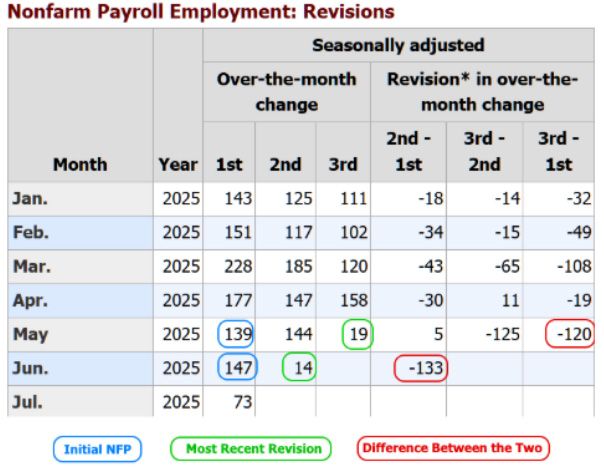

🧾 What Happened?

Friday’s “nonfarm payroll” report—aka the monthly jobs update—came in much weaker than expected:

73,000 new jobs added vs. 110,000 expected

But the bigger shock? The previous two months were revised down by 253,000 jobs

That’s like finding out the job market isn’t just slowing—it already slowed a while ago, and we’re just catching up.

💸 Why That Matters for Mortgage Rates

When the labor market weakens:

Investors tend to buy more bonds (a safe haven in uncertain times)

More bond buying = lower mortgage rates

Plus, the Fed becomes more likely to cut rates to stimulate the economy

Mortgage rates aren’t directly tied to the Fed’s rate, but they do move based on what markets think the Fed is going to do next.

And right now? 📉 Markets are betting on a Fed rate cut in September.

📉 What Did Rates Do?

By Friday:

Average 30-year fixed rates fell by about 0.125%

Some lenders (including us!) made mid-day improvements

We’re now approaching the lowest mortgage rates since October 2024

🔭 What’s Next?

This jobs report puts more pressure on upcoming economic data. Specifically:

Next inflation report (CPI) will be watched closely

Next jobs report (early September) is a big one—just 2 weeks before the Fed’s next meeting

If those numbers confirm the economy is cooling, rates could drop further. If not, we might bounce back up.

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Today's Mortgage Rates