Scotsman Guide is the nation’s most respected awards platform in the mortgage industry, and it’s truly humbling to be featured for:

- Top Purchase Volume

- Finishing 2024 as the #213 out of 150,000+ Loan Officers in the country

- Top Mortgage Brokers

- #1 Loan Officer at the Largest Mortgage Broker in America, NEXA Mortgage

- Most Loans Closed

- Top Dollar Volume

Representing McGowan Mortgages and NEXA Mortgage on a national level is a dream come true!

This achievement wouldn’t be possible without:

- Our amazing clients who trust us with one of the biggest decisions of their lives 🏡

- Our incredible Realtor partners who believe in us and make dreams happen 🤝

- My amazing wife, who hustles alongside me every day 💪

- And our incredible team, whose hard work and dedication inspire me daily 🙌

- We’re absolutely honored. Proud of what we’ve accomplished — and even more excited for what’s ahead. 🔥

Let’s keep raising the bar!

Needing to Buy BEFORE You Sell?

Want to buy your next home before selling your current one? 🏡💰

With our Instant HELOC program, you can tap into your home’s equity in as little as 7 days — making you a strong, non-contingent buyer in today’s competitive market.

No waiting. No missed opportunities. Just smart moves!

Let’s get you into your next home faster!

Will Rates Drop Soon? Here’s What’s Going On 🏦📉

There’s been a lot of talk lately about the Federal Reserve and interest rates—especially after a strong jobs report and some public pressure from President Trump. So, what does it all mean for mortgage rates? Let’s break it down 👇

🔹 What Did the Jobs Report Say?

Last week’s jobs report showed solid growth—more jobs were added than expected, and unemployment stayed low, even as more people entered the workforce. That’s a sign the economy is still strong, not slowing down.

👉 Why it matters: The Fed tends to cut rates when the economy is weakening. This report made it clear that things aren’t cooling off enough yet, so a rate cut is less likely at the Fed’s upcoming

🔹 Trump’s Push for Rate Cuts

President Trump has been urging the Fed to cut rates—and fast. But why?

The Federal government is carrying record debt—and lower interest rates would reduce the cost of paying it off.

Trump has suggested that high rates are hurting American competitiveness and growth.

But here’s the catch: 🔐 The Federal Reserve is independent, meaning it doesn’t take direction from the President. It makes decisions based on economic data—not political pressure.

🔹 So… What Should You Expect?

✅ A rate cut is not off the table for later this year, but the strong job market means the Fed is in no rush.

🚫 Political pressure alone (even from a former president) won’t force the Fed’s hand.

Bottom Line for Buyers & Homeowners 🏡:

Mortgage rates are still in a favorable range compared to late 2023. While we all want lower rates, they’re more likely to come when the economy shows clearer signs of slowing.

🏠 Real Estate & Mortgage Highlights – Early May 2025

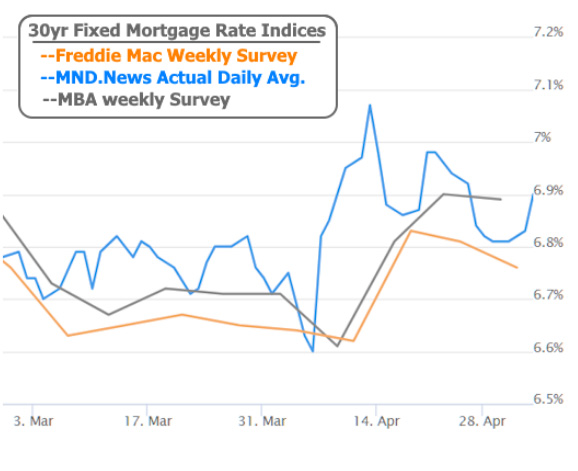

📉 Mortgage Rates See a Small Drop

Average 30-year fixed mortgage rates are around 6.81%.

This small decline from earlier in the year peaks is driven by slower economic growth and speculation about future Fed rate cuts.

Buyers may have a short window to lock in slightly better rates before summer demand heats up.

🏠 Starter Homes Are Now Topping $1 Million in Many Cities

In 2020, about 85 U.S. cities had starter homes priced at $1M or higher — today, it’s over 230 cities.

Inventory shortages and inflation have pushed starter home prices to new records, especially in coastal states.

Affordability remains one of the top challenges for first-time buyers.

📈 Home Prices Are Still Rising (But More Slowly)

Nationwide home price appreciation is projected to slow to about 2% in 2025 (compared to 4.5% in 2024).

While bidding wars have cooled slightly, low inventory continues to keep prices resilient in most markets.

This could be good news for buyers looking for slightly less competition — but waiting for a major price drop may not be realistic.

🏘️ “Affordable” Markets Are Heating Up

Secondary and Midwestern cities like Toledo, OH and Des Moines, IA are seeing major growth.

Example: Toledo’s median home price is still around $235,000 — nearly $200,000 below the national average.

More buyers are expanding their search to smaller, more affordable markets to find value.

💵 HELOCs and Home Equity Remain Popular

With mortgage rates still higher than many homeowners locked-in rates, home equity lines of credit (HELOCs) are seeing a surge.

Homeowners are tapping into equity for renovations, debt consolidation, and investments without giving up their low-rate first mortgage.

🛠️ Fed Policy Watch: Mortgage Rates Outlook

Analysts expect the Federal Reserve may start cutting rates later this year if inflation cools further.

Lower Fed rates could lead to some softening in mortgage rates, but experts suggest we won’t return to ultra-low pandemic levels.

This Week in Mortgage Rates📈

Why Did Rates Go Up a Bit This Week? 🏡📊

If you’re watching mortgage rates, you might have noticed a small bump up this week. Here’s the quick story:

The economy showed signs of being stronger than expected—not booming, but also not struggling like some thought it might be. That news came from reports on manufacturing and jobs, which both came in better than forecasted.

- Manufacturing reports showed a bit more life than expected.

- Job growth was solid, and more people joined the workforce.

- Inflation concerns are still lingering, which keeps pressure on rates.

Because mortgage rates tend to follow the bond market—and the bond market reacts to economic data—this kind of news usually leads to a slight rise in rates.

Important note: Some articles may say rates dropped this week, but they’re using outdated survey data that missed the increases on Thursday and Friday.

The silver lining? ✨ Rates are still within a good range—especially compared to where they were last fall. If you’re house hunting or considering a refinance, it’s still a great time to explore your options!

🏡 Housing Market Snapshot: What Buyers Need to Know (May 2025)

📉 Existing Home Sales Slowed in March

Existing home sales fell 5.9% to a 4.02 million annual pace — a little weaker than expected.

This slowdown reflects buyers shopping earlier this year when mortgage rates were a bit higher.

🧯 Fires out West may have also delayed some closings.

🏠 Home Prices Are Holding Strong

Despite fewer sales, the median home price still rose 1.7% in March to $403,700 — the highest March on record! 📈

Year-over-year, home prices are up 2.7%.

Important: this measures the middle price of homes sold — not overall appreciation.

🏘️ Inventory Is Growing (Slowly)

Housing inventory rose 8.1% last month to 1.33 million homes.

That’s 20% more than this time last year, but still much lower than historic levels.

🏡 For context, inventory is still nearly 3 million homes fewer than during the last housing bubble!

⏳ Market Balance Update

We now have about a 4-month supply of homes — a bit more than February’s 3.5%, but still shy of the ideal “balanced market” level of 4.6 months.

Homes spent an average of 36 days on the market, a faster pace compared to 42 days in February.

📈 About 21% of homes sold above list price (down from 29% last year).

👫 Who’s Buying?

First-time buyers made up 32% of purchases, a small rise from February’s 31%.

Investors made up 15% of buyers — steady from last year.

💵 Cash buyers accounted for about 26% of all purchases.

🏡 Mortgage & Market Update: Calm After the Storm

Just a quick update on what’s happening with mortgage rates and the markets. (Don’t worry — we stay completely apolitical — we’re just here to help you understand how this affects YOU as a homeowner or homebuyer! 🏠)

🌪️ What Happened:

Last month, news about new tariffs caused a lot of market chaos. 📈📉

Then, some comments about the Federal Reserve added even more drama.

But GOOD NEWS — things have started calming down! 😌

✅ Why It Matters:

Markets loved hearing that trade talks with China might be handled more carefully.

Plus, there was a reversal on some negative Fed news that made everyone breathe easier.

As a result, mortgage rates have settled down after a bumpy few weeks. 🛬

⚡ Are Rates All the Way Back to Normal?

Rates have improved but haven’t fully returned to where they were before the chaos.

Even so, it’s a much better environment for homebuyers right now than it was a few weeks ago! 🏡💰

📈 Forecast Summary

Short-Term (Next 1-2 Weeks): Rates are likely to hover around current levels, with minor fluctuations based on upcoming economic data releases.

Medium-Term (Next Few Months): If economic indicators point towards a slowdown and inflation decreases, there’s potential for gradual rate reductions.

🏡 Advice for Homebuyers and Realtors

Stay Informed: Keep an eye on economic reports, especially those related to employment and inflation, as they can influence mortgage rates.

Consider Locking Rates: If you’re in the process of securing a mortgage and are comfortable with current rates, it might be wise to lock in to avoid potential increases.

Consult Professionals: Engage with mortgage advisors to explore options tailored to your financial situation.

🎯 Bottom Line:

Markets are calmer ✅

Mortgage rates are steadying ✅

It’s still a great time to make a move if you’re thinking about buying or refinancing! 🏠✨

As always, we’re here to help answer questions and guide you through every step! 🤝

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Today's Mortgage Rates